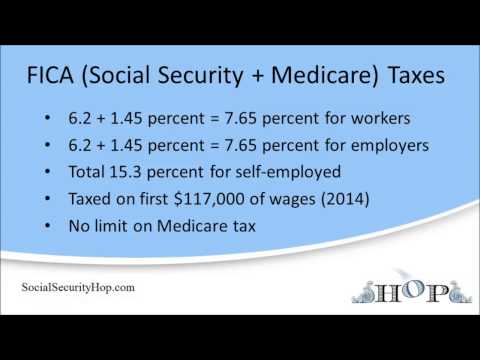

And we've already begun to see the squeeze that the long-living baby-boomers will place on Social Security. Social Security taxes already have increased and benefits already have been cut. Social Security taxes, known as payroll or FICA taxes, increased from less than 6% in nineteen seventy-six to seven point six five percent in 1990. This rate is levied on both employees and employers, so the total FICA tax is now over fifteen percent of your salary. Also, the taxable wage base grew dramatically over this time. In 1976, you paid FICA taxes on only the first $17,000 in wages. Now, you pay taxes on your first sixty-two thousand dollars in wages. By the way, FICA stands for Federal Insurance Contributions Act, but make no mistake, these are taxes, not contributions. If you decide not to contribute this year, you'll be getting a telephone call. The IRS almost ruthlessly pursues those who don't pay their payroll taxes. FICA taxes are also hard to avoid. There are no exemption levels as there are with income taxes. You pay FICA taxes on your first dollar of wages. Although you can defer income taxes via retirement accounts, you can't avoid FICA taxes. So, FICA taxes hit low-income people especially hard.

Award-winning PDF software

Social Security Tax Withholding calculator Form: What You Should Know

Social Security benefits). Social Security Withholding and Social Security Tax: Not much, not much, just the 1.45% of your wages in your pocket, plus the 3.8% of your wages that is deducted from any payment that comes in and goes to the Federal government and then into the trust fund, will do quite a bit to help you. The chart doesn't show the fact that Medicare withholding is already taking from your paycheck. If you are making over 113,200 this year this is the first tax you may get, and you may get a tax refund of 10% of your Medicare deductions. So you get to keep some deductions to lower your overall tax. That is important (which is why you do it right now!). For a full explanation of the Social Security and Medicare taxes that you may face contact us. You also may wish to contact us and let us know about any deductions you wish to claim for the year. For the latest Social Security news and tips visit . Social Security withholding and Medicare tax forms and instructions : H&R Block Form W-4 Withholding and Medicare tax: H&R Block Ways to Lower Your Tax Withholding Here are some of the ways you can lower your tax withholding and income tax with Social Security and Medicare. You may wish to contact us as well about any deductions, credits, deductions, and the like you may be interested in. If income and/or Social Security tax are the only taxes you file, you may be under the impression that your taxes are paid. However, it is your payments for those taxes that pay the other taxes and are the basis (as well as the payment made by you) for the tax system. All of these are the way you pay, whether it be Social Security or Medicare. Social Security: You can have Social Security tax withheld from your wages or your W-2 wages, for tax year 2 Medicare: Here is another way to lower your withholding and income taxes with Medicare. The payment for you taxes is made first and then any payment by the government goes into a trust fund that is then used to help pay any other taxes. You can use your tax payments to lower your taxes, to lower your payment. That is exactly what Social Security tax is supposed to do. You also can have a small deduction of 1% or more on Social Security taxes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-4V, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-4V online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-4V by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-4V from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Social Security Tax Withholding calculator